Chat with Fundamentals v2.0.0 Technical Documentation

Complete reference for financial research and portfolio management platform

What is Chat with Fundamentals?

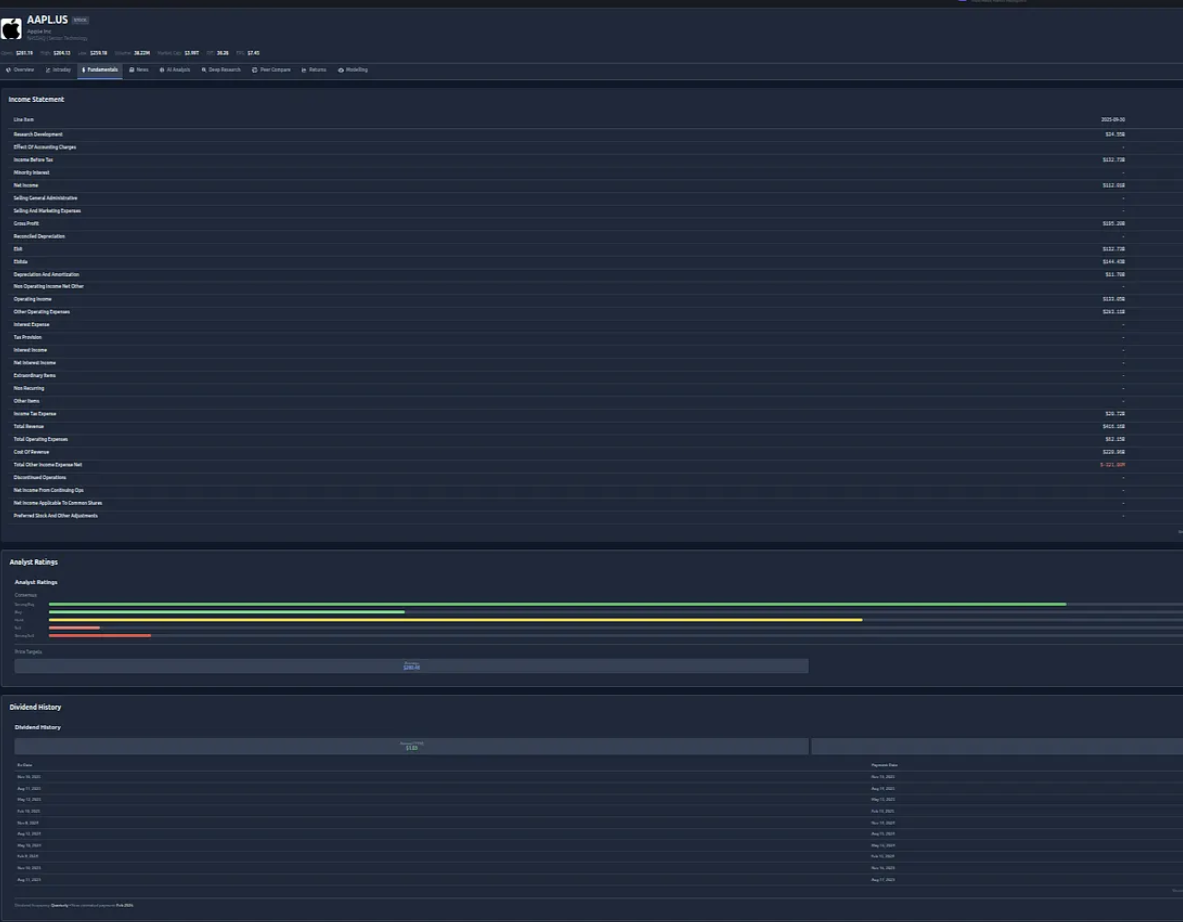

Chat with Fundamentals is a full-stack financial research and portfolio management platform designed to automate and enhance financial analysis through AI-powered tools. The platform features:

- Multi-Agent AI Analysis: Autonomous agents for analyzing stocks, ETFs, forex, and macro indicators

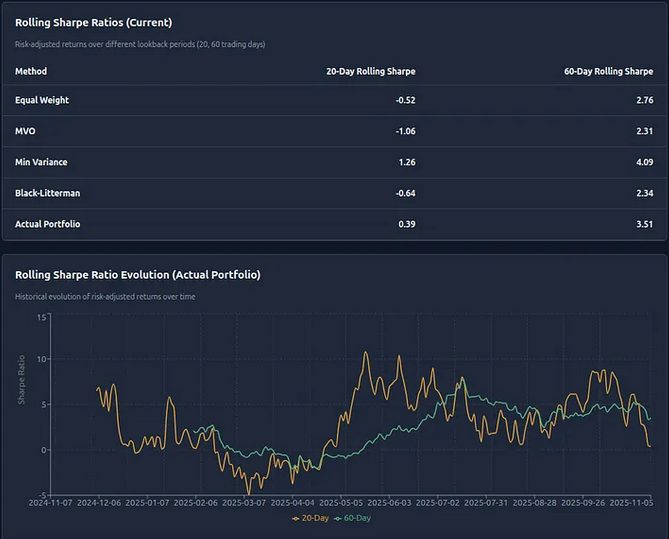

- Portfolio Management: Shares-based tracking with 5 optimization strategies (Actual, Equal Weight, MVO, Min Variance, Black-Litterman)

- RAG Systems: Retrieval-Augmented Generation for quant research papers and SEC filings

- Comprehensive Data Integration: 50+ EODHD API endpoints across 9 categories

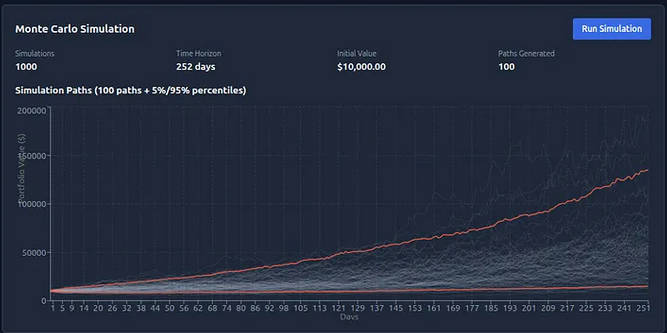

- Advanced Analytics: Monte Carlo simulations, VaR, CVaR, rolling Sharpe ratios

- Database Management: PostgreSQL + TimescaleDB + Redis + ChromaDB architecture

- Real-Time Monitoring: WebSocket-based agent console for live debugging

Key Features

Portfolio Management

- Shares-based position tracking

- 5 optimization strategies

- Multi-asset support (stocks, ETFs, forex)

- Performance attribution

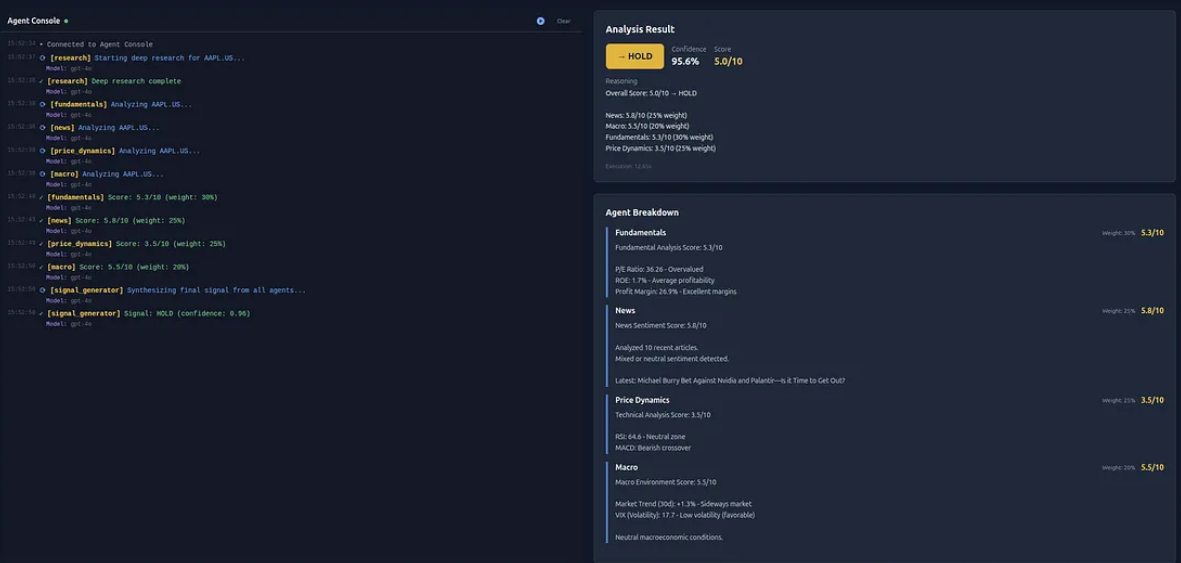

AI Analysis

- 4 specialized agents (fundamentals, news, price, macro)

- BUY/HOLD/SELL recommendations

- Real-time WebSocket logging

- Agent console for debugging

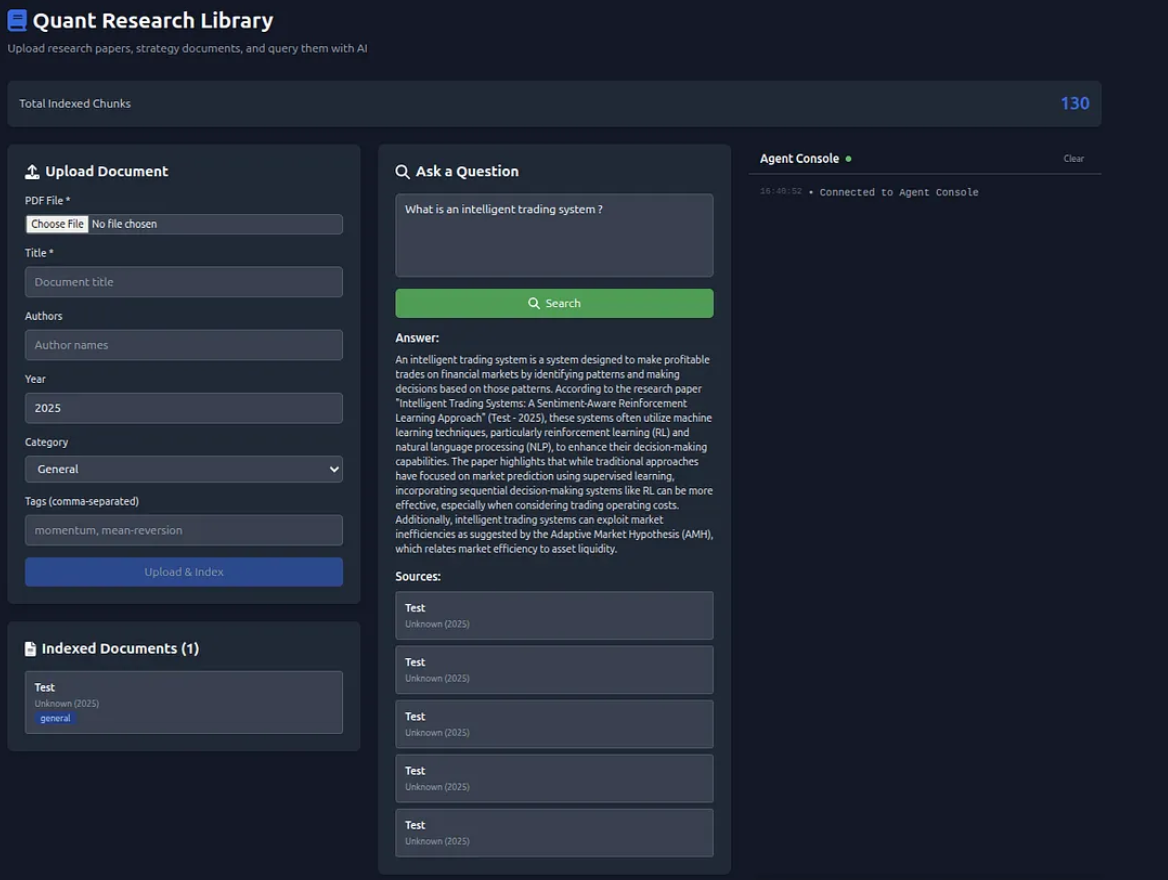

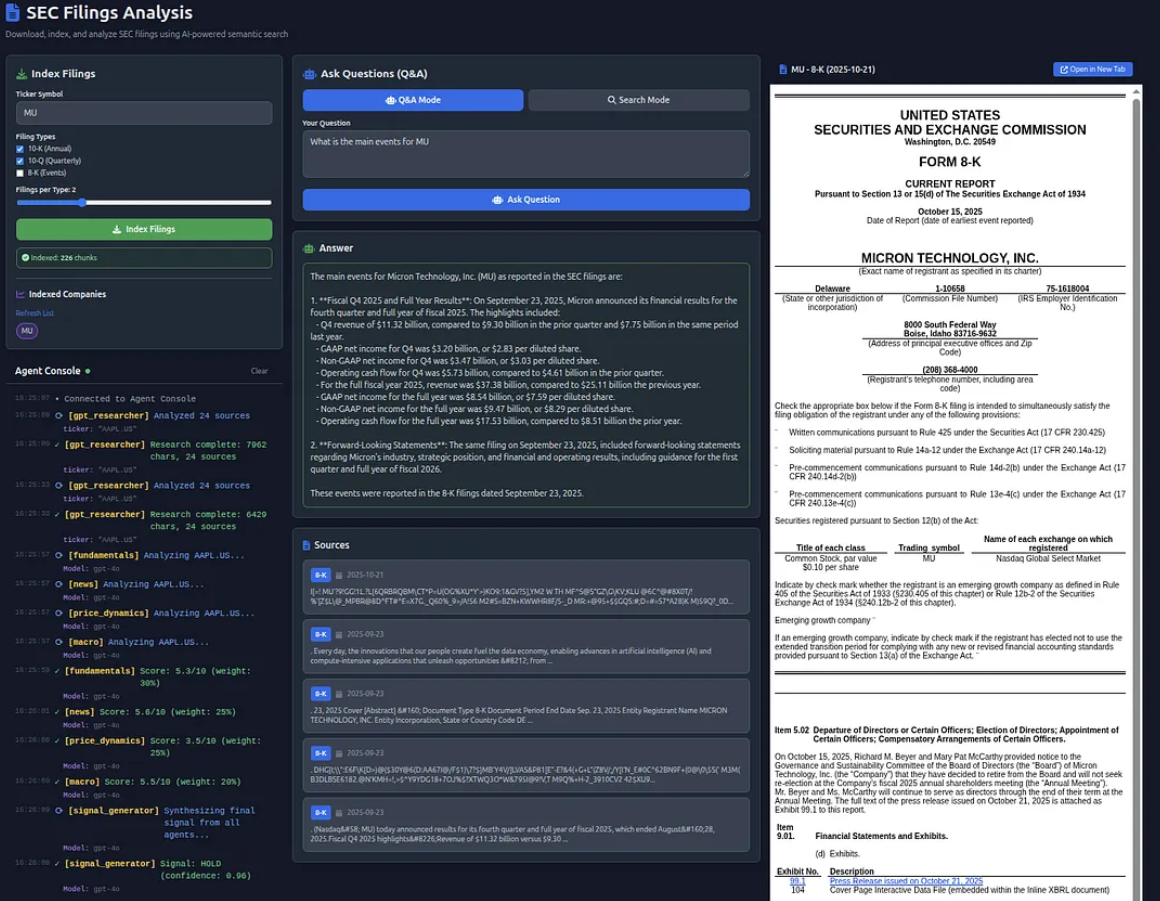

RAG Systems

- Quant research paper library

- SEC filings analysis (10-K, 10-Q, 8-K)

- ChromaDB vector storage

- OpenAI embeddings

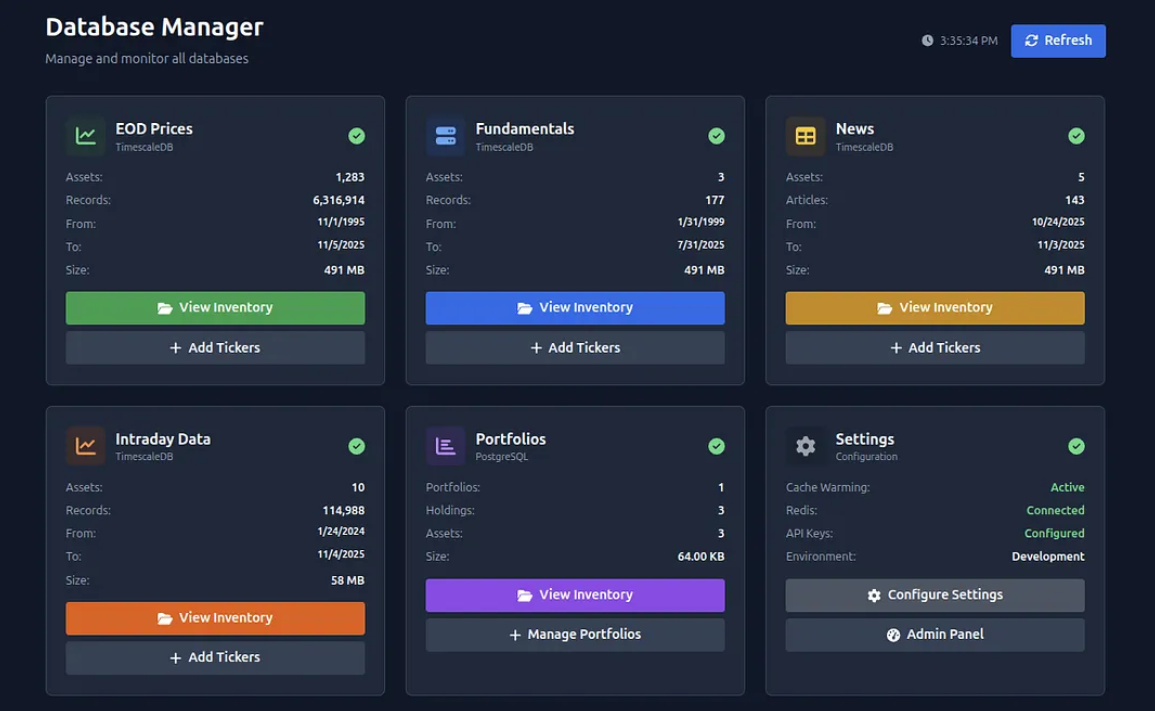

Database Management

- Fundamentals data management

- Price history storage (TimescaleDB)

- News aggregation

- Multiple asset types

Risk Analytics

- Monte Carlo simulations

- VaR & CVaR calculations

- Rolling Sharpe ratios

- Correlation analysis

EODHD Integration

- 50+ API endpoints

- 9 data categories

- Real-time & historical data

- Fundamentals & financials

System Architecture

High-Level Overview

Chat with Fundamentals uses a modern full-stack architecture with clear separation between frontend, backend, and data layers:

Architecture Components

Frontend Layer (Next.js 13+)

- React 18: Component-based UI with hooks and context

- TypeScript: Type-safe development

- TailwindCSS: Utility-first styling

- shadcn/ui: Accessible component library

- Recharts: Financial charts and visualizations

- WebSocket Client: Real-time agent console updates

Backend Layer (FastAPI)

- FastAPI Framework: High-performance async Python API

- Pydantic Models: Data validation and serialization

- SQLAlchemy ORM: Database abstraction layer

- WebSocket Server: Real-time agent logging

- CrewAI Integration: Multi-agent orchestration

- LangChain: RAG pipeline and embeddings

Data Layer

- PostgreSQL: Primary relational database for fundamentals, portfolios, users

- TimescaleDB Extension: Time-series optimization for price data

- Redis: Caching layer for API responses and session management

- ChromaDB: Vector database for RAG embeddings

External Services

- EODHD API: Market data provider (50+ endpoints)

- OpenAI API: GPT models for MarketSense AI and RAG

- SEC EDGAR: Public filings data source

Installation & Setup

Prerequisites

- Python 3.10+

- Node.js 18+

- PostgreSQL 14+

- Redis 7+

- Docker & Docker Compose (optional)

Backend Setup

1. Clone Repository & Install Dependencies

# Navigate to backend directory

cd backend

# Create virtual environment

python -m venv venv

source venv/bin/activate # On Windows: venv\Scripts\activate

# Install dependencies

pip install -r requirements.txt2. Configure Environment Variables

Create .env file in backend directory:

# Database

DATABASE_URL=postgresql://user:password@localhost:5432/chat_with_fundamentals

REDIS_URL=redis://localhost:6379

# API Keys

EODHD_API_KEY=your_eodhd_api_key

OPENAI_API_KEY=your_openai_api_key

# ChromaDB

CHROMA_PERSIST_DIR=./chroma_db

# Server

API_HOST=0.0.0.0

API_PORT=80003. Initialize Database

# Run migrations

alembic upgrade head

# Create TimescaleDB hypertables

python -m app.db.init_timescale4. Start Backend Server

# Development mode with auto-reload

uvicorn app.main:app --reload --host 0.0.0.0 --port 8000

# Production mode

uvicorn app.main:app --host 0.0.0.0 --port 8000 --workers 4Frontend Setup

1. Install Dependencies

# Navigate to frontend directory

cd frontend

# Install npm packages

npm install2. Configure Environment Variables

Create .env.local file in frontend directory:

NEXT_PUBLIC_API_URL=http://localhost:8000

NEXT_PUBLIC_WS_URL=ws://localhost:80003. Start Development Server

# Development mode

npm run dev

# Build for production

npm run build

# Start production server

npm startDocker Deployment

# Build and start all services

docker-compose up -d

# View logs

docker-compose logs -f

# Stop services

docker-compose downTechnology Stack

Frontend Technologies

| Technology | Version | Purpose |

|---|---|---|

| Next.js | 13+ | React framework with SSR and routing |

| React | 18 | UI component library |

| TypeScript | 5 | Type-safe JavaScript |

| TailwindCSS | 3 | Utility-first CSS framework |

| shadcn/ui | Latest | Accessible component library |

| Recharts | 2 | Chart library for data visualization |

Backend Technologies

| Technology | Version | Purpose |

|---|---|---|

| FastAPI | 0.104+ | High-performance async web framework |

| Python | 3.10+ | Backend programming language |

| SQLAlchemy | 2.0 | ORM for database operations |

| Pydantic | 2.0 | Data validation and serialization |

| CrewAI | Latest | Multi-agent orchestration framework |

| LangChain | Latest | RAG pipeline and embeddings |

| PyPortfolioOpt | 1.5+ | Portfolio optimization algorithms |

Database & Storage

| Technology | Version | Purpose |

|---|---|---|

| PostgreSQL | 14+ | Primary relational database |

| TimescaleDB | 2.11+ | Time-series extension for price data |

| Redis | 7+ | Caching and session management |

| ChromaDB | Latest | Vector database for RAG embeddings |

External APIs

| Service | Purpose |

|---|---|

| EODHD API | Market data, fundamentals, financials |

| OpenAI API | GPT models for AI analysis and embeddings |

| SEC EDGAR | Public company filings |

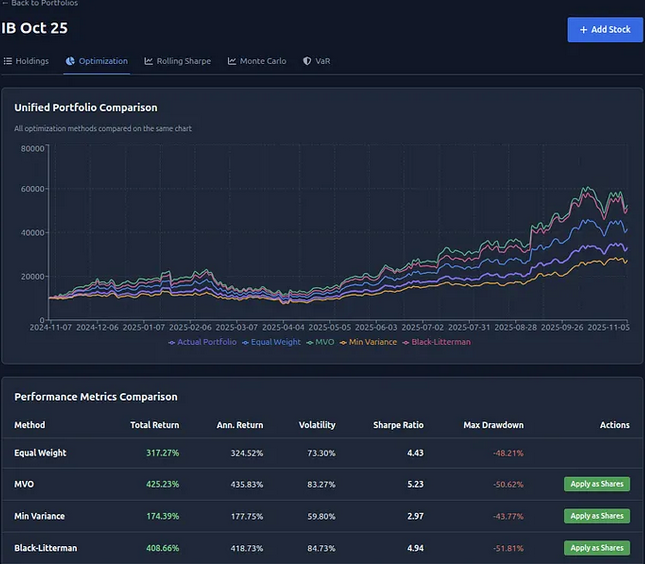

Portfolio Management

Overview

The Portfolio Management module provides comprehensive tools for tracking and optimizing investment portfolios with shares-based position tracking and advanced optimization strategies.

Core Features

- Shares-Based Tracking: Track positions by number of shares (not just dollar amounts)

- 5 Optimization Strategies: Actual, Equal Weight, MVO, Min Variance, Black-Litterman

- Multi-Asset Support: Stocks, ETFs, forex pairs

- Performance Attribution: Analyze returns by position and time period

- Real-Time Updates: Live portfolio value updates based on market prices

- Historical Tracking: Daily snapshots for performance analysis

Optimization Strategies

1. Actual Portfolio

Your current holdings as entered in the system, reflecting your real investment positions.

2. Equal Weight

Allocates portfolio value equally across all positions:

weight_i = 1 / N

where N = number of positions3. Mean-Variance Optimization (MVO)

Maximizes Sharpe ratio using historical returns and covariance:

max w^T μ - λ/2 w^T Σ w

subject to: w^T 1 = 1, w ≥ 0

where:

w = portfolio weights

μ = expected returns

Σ = covariance matrix

λ = risk aversion parameter4. Minimum Variance

Minimizes portfolio volatility regardless of expected returns:

min w^T Σ w

subject to: w^T 1 = 1, w ≥ 05. Black-Litterman

Combines market equilibrium with investor views:

E[R] = [(τΣ)^-1 + P^T Ω^-1 P]^-1 [(τΣ)^-1 Π + P^T Ω^-1 Q]

where:

Π = market equilibrium returns

P = view matrix

Q = view returns

Ω = view uncertainty

τ = scaling factor

API Endpoints

Get current portfolio positions with real-time prices

Source: backend/app/api/portfolio.py:45-78

# Response

{

"positions": [

{

"symbol": "AAPL",

"shares": 100,

"avg_cost": 150.25,

"current_price": 175.50,

"market_value": 17550.00,

"unrealized_pnl": 2525.00,

"unrealized_pnl_pct": 16.81

}

],

"total_value": 125000.00,

"total_cost": 100000.00,

"total_pnl": 25000.00

}Optimize portfolio using selected strategy

Source: backend/app/api/portfolio.py:125-189

# Request

{

"strategy": "mvo", // actual | equal_weight | mvo | min_variance | black_litterman

"risk_free_rate": 0.045,

"lookback_days": 252

}

# Response

{

"strategy": "mvo",

"weights": {

"AAPL": 0.25,

"MSFT": 0.30,

"GOOGL": 0.20,

"AMZN": 0.25

},

"metrics": {

"expected_return": 0.185,

"volatility": 0.142,

"sharpe_ratio": 0.98

}

}Add or update portfolio position

Source: backend/app/api/portfolio.py:80-123

# Request

{

"symbol": "AAPL",

"shares": 100,

"avg_cost": 150.25,

"transaction_date": "2025-01-15"

}

# Response

{

"position_id": 123,

"symbol": "AAPL",

"shares": 100,

"avg_cost": 150.25

}

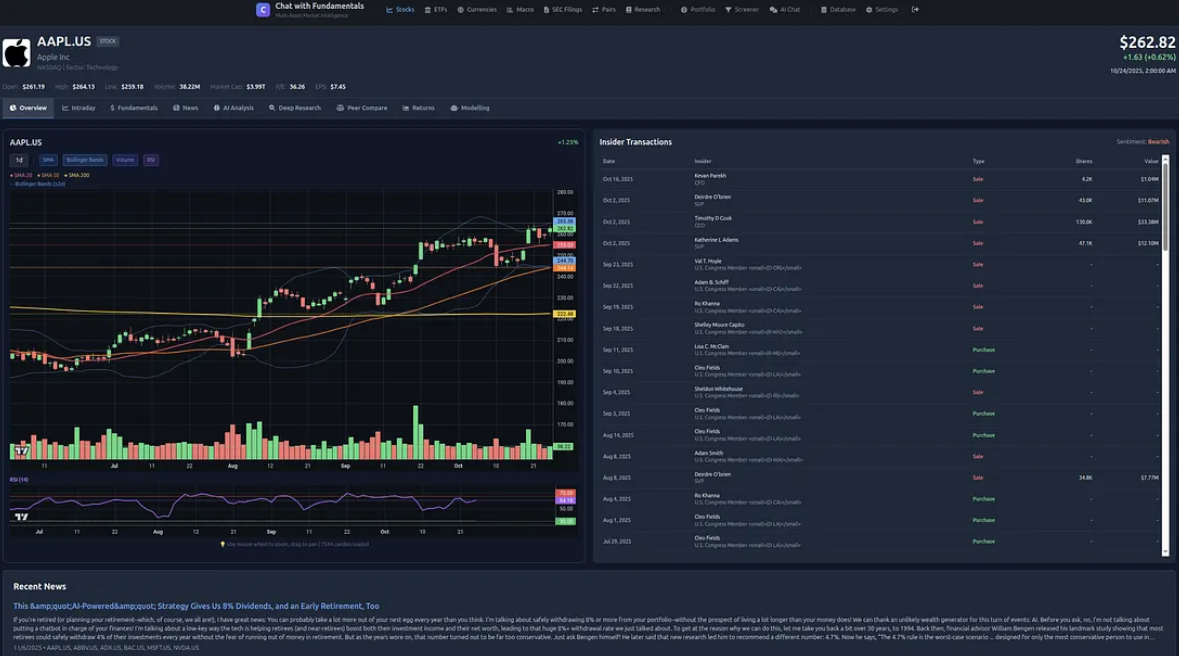

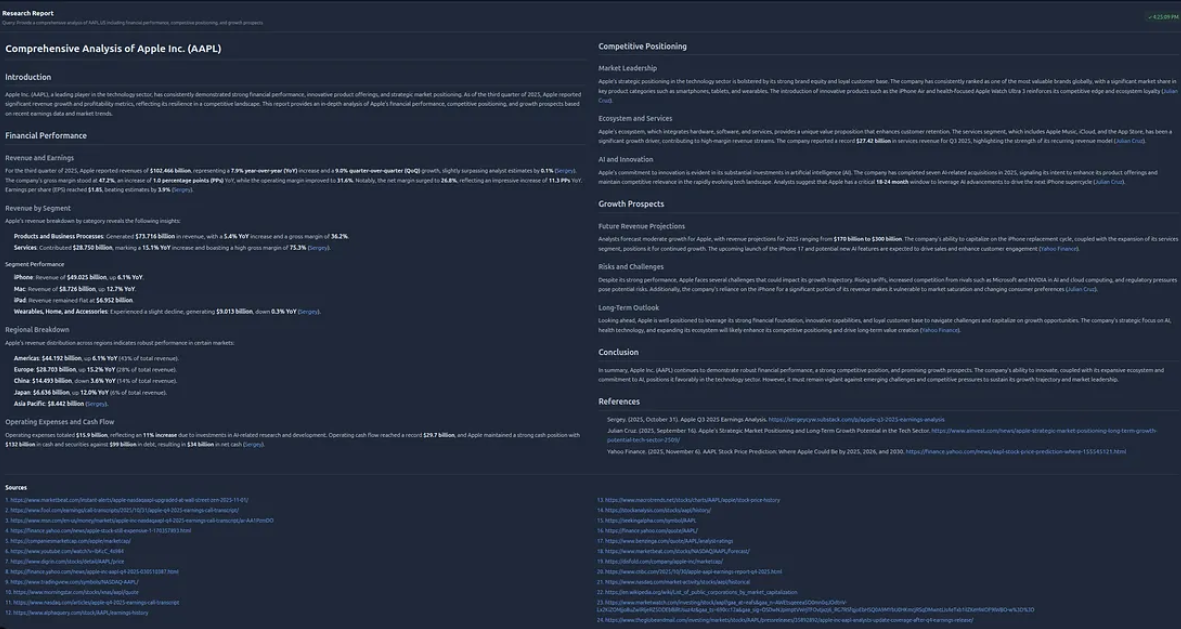

AI Analysis

Overview

The AI Analysis module is a multi-agent system built with CrewAI that provides comprehensive stock analysis through four specialized agents. Inspired by multi-agent frameworks for financial analysis.

Agent Architecture

1. Fundamentals Agent

- Role: Analyzes company financials and fundamentals

- Data Sources: Income statements, balance sheets, cash flow statements

- Metrics: P/E ratio, debt-to-equity, profit margins, revenue growth

- Output: Fundamental strength score (1-10)

2. News Agent

- Role: Analyzes recent news sentiment and major events

- Data Sources: Financial news, press releases, earnings calls

- Analysis: Sentiment analysis, event impact assessment

- Output: News sentiment score (-10 to +10)

3. Price Agent

- Role: Technical analysis and price pattern recognition

- Data Sources: Historical prices, volume, technical indicators

- Analysis: Trend identification, support/resistance, momentum

- Output: Technical score (1-10)

4. Macro Agent

- Role: Analyzes macroeconomic environment and sector trends

- Data Sources: Economic indicators, sector performance, market conditions

- Analysis: Interest rates, GDP growth, sector rotation

- Output: Macro environment score (1-10)

Final Recommendation

A Portfolio Manager agent synthesizes all agent outputs to generate:

- Signal: BUY / HOLD / SELL

- Conviction: 1-10 score indicating confidence level

- Reasoning: Detailed explanation of recommendation

- Risk Factors: Key risks to monitor

Agent Console

Real-time WebSocket-based debugging console showing agent thought processes:

- Live agent status updates

- Task execution logs

- Tool usage tracking

- Error messages and warnings

API Endpoints

Run AI analysis on a symbol

Source: backend/app/api/marketsense.py:34-112

# Request

{

"symbol": "AAPL",

"analysis_type": "stock", // stock | etf | forex | macro

"llm_provider": "openai" // openai | anthropic

}

# Response

{

"symbol": "AAPL",

"timestamp": "2025-01-15T10:30:00Z",

"signal": "BUY",

"conviction": 8,

"agent_scores": {

"fundamentals": 9,

"news": 7,

"price": 8,

"macro": 7

},

"reasoning": "Strong fundamentals with positive earnings surprise...",

"risk_factors": ["Regulatory concerns", "Valuation metrics"],

"execution_time_seconds": 45.2

}WebSocket endpoint for real-time agent console

Source: backend/app/api/websocket.py:23-67

# WebSocket Messages

{

"event": "agent_status",

"agent": "fundamentals",

"status": "running",

"message": "Analyzing financial statements..."

}

{

"event": "task_complete",

"agent": "news",

"output": "Positive sentiment from recent earnings call"

}

{

"event": "final_recommendation",

"signal": "BUY",

"conviction": 8

}RAG Systems

Overview

Chat with Fundamentals includes two Retrieval-Augmented Generation (RAG) systems for querying quantitative research papers and SEC filings using natural language.

1. Quant Research Library RAG

Semantic search over a curated library of quantitative finance research papers.

Features

- Paper Collection: 500+ academic papers on quant strategies, risk management, portfolio optimization

- Semantic Search: Find relevant papers using natural language queries

- Citation Tracking: Automatically includes paper titles, authors, years

- Context Retrieval: Returns relevant sections with page numbers

Implementation

- Vector Store: ChromaDB

- Embeddings: OpenAI text-embedding-3-small

- Chunking: ~1000 tokens with 200-token overlap

- Retrieval: Top-k similarity search (k=5)

2. SEC Filings RAG

Query company SEC filings (10-K, 10-Q, 8-K) using natural language.

Features

- Filing Types: 10-K (annual), 10-Q (quarterly), 8-K (current events)

- Company Coverage: All public US companies

- Historical Data: Filings from 2020-present

- Section Extraction: Automatically parses standard SEC sections

Common Queries

- "What are the key risk factors for AAPL?"

- "Summarize MSFT's revenue breakdown by segment"

- "What did TSLA say about production capacity in their latest 10-Q?"

- "Compare GOOGL's R&D spending over the last 3 years"

RAG Pipeline

1. User Query → Embedding

2. Vector Search → Retrieve Top-k Chunks

3. Context + Query → LLM (GPT-4)

4. LLM Response → Citation Formatting

5. Return Answer with SourcesAPI Endpoints

Query quantitative research paper library

Source: backend/app/api/rag.py:45-98

# Request

{

"query": "What are the best momentum strategies for equity markets?",

"top_k": 5

}

# Response

{

"answer": "Based on the research papers, the most effective momentum strategies...",

"sources": [

{

"title": "Momentum Strategies in Equity Markets",

"authors": ["Smith, J.", "Doe, A."],

"year": 2022,

"page": 15,

"excerpt": "...relevant text..."

}

],

"execution_time_seconds": 2.3

}Query SEC filings for specific companies

Source: backend/app/api/rag.py:100-156

# Request

{

"symbol": "AAPL",

"query": "What are the main risk factors?",

"filing_types": ["10-K", "10-Q"],

"years": [2023, 2024]

}

# Response

{

"answer": "Apple's main risk factors include...",

"sources": [

{

"symbol": "AAPL",

"filing_type": "10-K",

"filing_date": "2024-11-03",

"section": "Risk Factors",

"page": 8,

"excerpt": "...relevant text..."

}

]

}

Database Management

Overview

The Database Management module provides comprehensive tools for managing fundamentals data, price history, and news across multiple asset types (stocks, ETFs, forex).

Core Features

- Fundamentals Management: Store and retrieve company financial data

- Price History: TimescaleDB-optimized time-series storage

- News Aggregation: Store and search financial news articles

- Multi-Asset Support: Stocks, ETFs, forex pairs, macro indicators

- Data Validation: Automatic validation and cleaning

- Bulk Operations: Efficient batch updates

Database Schema Highlights

Fundamentals Table

fundamentals (

id SERIAL PRIMARY KEY,

symbol VARCHAR(20) NOT NULL,

market_cap BIGINT,

pe_ratio FLOAT,

forward_pe FLOAT,

peg_ratio FLOAT,

price_to_book FLOAT,

debt_to_equity FLOAT,

roe FLOAT,

dividend_yield FLOAT,

eps FLOAT,

revenue BIGINT,

net_income BIGINT,

sector VARCHAR(100),

industry VARCHAR(100),

last_updated TIMESTAMP,

UNIQUE(symbol)

)Price History (TimescaleDB Hypertable)

price_history (

time TIMESTAMP NOT NULL,

symbol VARCHAR(20) NOT NULL,

open FLOAT,

high FLOAT,

low FLOAT,

close FLOAT,

volume BIGINT,

adjusted_close FLOAT,

PRIMARY KEY (time, symbol)

)

-- Hypertable partitioned by timeNews Articles

news_articles (

id SERIAL PRIMARY KEY,

symbol VARCHAR(20),

title TEXT,

content TEXT,

source VARCHAR(200),

published_at TIMESTAMP,

sentiment FLOAT,

url TEXT,

FOREIGN KEY (symbol) REFERENCES symbols(symbol)

)API Endpoints

Get fundamentals data for a symbol

Source: backend/app/api/database.py:34-67

# Response

{

"symbol": "AAPL",

"market_cap": 2850000000000,

"pe_ratio": 28.5,

"forward_pe": 25.2,

"peg_ratio": 2.1,

"price_to_book": 42.3,

"debt_to_equity": 1.73,

"roe": 0.147,

"dividend_yield": 0.0052,

"eps": 6.15,

"revenue": 383285000000,

"net_income": 96995000000,

"sector": "Technology",

"industry": "Consumer Electronics",

"last_updated": "2025-01-15T09:00:00Z"

}Update fundamentals data (single or bulk)

Source: backend/app/api/database.py:69-115

# Request (single)

{

"symbol": "AAPL",

"data": {

"market_cap": 2850000000000,

"pe_ratio": 28.5,

...

}

}

# Request (bulk)

{

"symbols": ["AAPL", "MSFT", "GOOGL"],

"fetch_from_eodhd": true

}Get price history for a symbol

Source: backend/app/api/database.py:117-165

# Query Parameters

?start_date=2024-01-01&end_date=2024-12-31&interval=daily

# Response

{

"symbol": "AAPL",

"prices": [

{

"time": "2024-01-02T00:00:00Z",

"open": 185.64,

"high": 187.02,

"low": 182.16,

"close": 184.25,

"volume": 82488500,

"adjusted_close": 184.25

}

]

}Get news articles for a symbol

Source: backend/app/api/database.py:167-205

# Query Parameters

?limit=20&offset=0&days=30

# Response

{

"symbol": "AAPL",

"total_count": 156,

"articles": [

{

"id": 12345,

"title": "Apple announces new product line",

"content": "...",

"source": "Reuters",

"published_at": "2025-01-15T08:00:00Z",

"sentiment": 0.75,

"url": "https://..."

}

]

}EODHD Data API Integration

Overview

Chat with Fundamentals integrates with EODHD (End of Day Historical Data) API to provide comprehensive financial market data. The platform wraps 50+ EODHD endpoints across 9 categories.

API Categories

1. Market Data (7 endpoints)

- Real-time quotes

- Historical EOD prices

- Intraday data

- Live prices

- Technical indicators

2. Fundamentals (12 endpoints)

- Company fundamentals

- Financial statements (income, balance sheet, cash flow)

- Earnings history

- Analyst recommendations

- Insider transactions

3. Calendar Data (5 endpoints)

- Earnings calendar

- IPO calendar

- Splits calendar

- Dividends calendar

4. News (3 endpoints)

- Financial news by symbol

- General market news

- Sentiment analysis

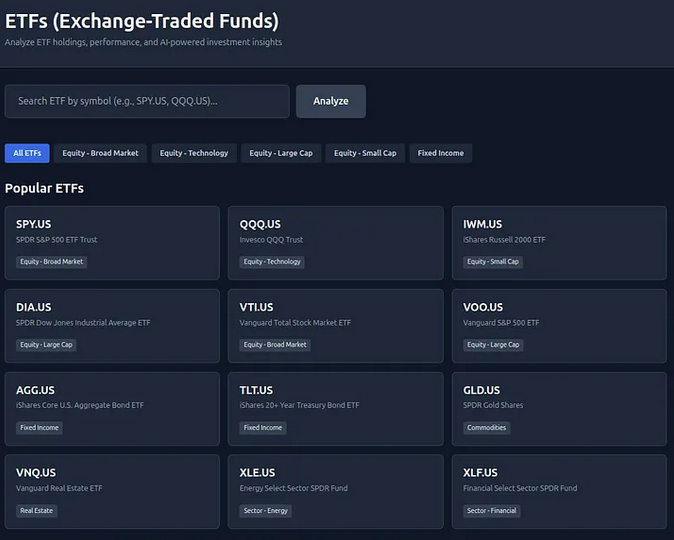

5. ETF Data (6 endpoints)

- ETF fundamentals

- Holdings data

- Sector allocations

- Performance metrics

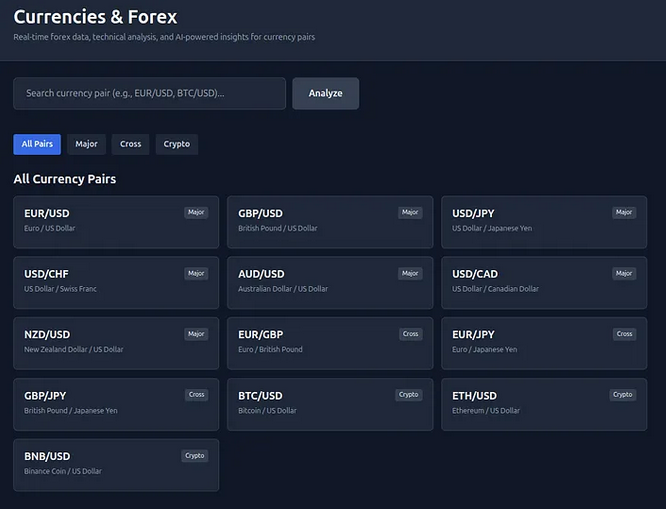

6. Forex & Crypto (4 endpoints)

- Currency exchange rates

- Cryptocurrency prices

- Historical forex data

7. Macro Indicators (8 endpoints)

- GDP data

- Inflation rates

- Interest rates

- Employment data

- Consumer confidence

8. Options (3 endpoints)

- Options chain data

- Historical options prices

- Implied volatility

9. Screener & Search (2 endpoints)

- Stock screener

- Symbol search

API Wrapper Implementation

All EODHD endpoints are wrapped in a unified FastAPI interface with:

- Caching: Redis caching to reduce API calls

- Rate Limiting: Automatic rate limit handling

- Error Handling: Graceful degradation on API errors

- Data Validation: Pydantic models for all responses

- Batch Operations: Efficient multi-symbol requests

Example API Endpoints

Get real-time quote for a symbol

Source: backend/app/api/eodhd.py:45-78

# Response

{

"code": "AAPL.US",

"timestamp": 1705324800,

"close": 185.64,

"high": 187.02,

"low": 182.16,

"open": 182.15,

"volume": 82488500,

"previousClose": 181.18,

"change": 4.46,

"change_p": 2.46

}Get company fundamentals

Source: backend/app/api/eodhd.py:80-145

# Response (partial - very large object)

{

"General": {

"Code": "AAPL",

"Name": "Apple Inc",

"Exchange": "US",

"Sector": "Technology",

"Industry": "Consumer Electronics",

"MarketCapitalization": 2850000000000

},

"Highlights": {

"MarketCapitalization": 2850000000000,

"EBITDA": 130541000000,

"PERatio": 28.51,

"PEGRatio": 2.14,

...

},

"Valuation": {...},

"Financials": {

"Balance_Sheet": {...},

"Income_Statement": {...},

"Cash_Flow": {...}

}

}Get upcoming earnings calendar

Source: backend/app/api/eodhd.py:235-278

# Query Parameters

?from=2025-01-15&to=2025-01-22

# Response

{

"earnings": [

{

"code": "AAPL.US",

"report_date": "2025-01-18",

"date": "2025-01-18",

"before_after_market": "AfterMarket",

"currency": "USD",

"estimate": "2.10",

"actual": null

}

]

}

API Reference Overview

Base URL

http://localhost:8000/apiAuthentication

All API endpoints require authentication via JWT token in the Authorization header:

Authorization: Bearer <jwt_token>Rate Limiting

API endpoints are rate-limited to prevent abuse:

- Authenticated users: 100 requests per minute

- Unauthenticated: 10 requests per minute

Response Format

All responses follow a consistent JSON structure:

{

"data": {...}, // Response data

"error": null, // Error message (if any)

"timestamp": "...", // ISO 8601 timestamp

"execution_time": 0.123 // Execution time in seconds

}Error Handling

Errors return appropriate HTTP status codes with detailed messages:

{

"data": null,

"error": {

"code": "VALIDATION_ERROR",

"message": "Invalid symbol format",

"details": {...}

},

"timestamp": "2025-01-15T10:30:00Z"

}Common HTTP Status Codes

| Code | Meaning |

|---|---|

| 200 | OK - Request successful |

| 201 | Created - Resource created successfully |

| 400 | Bad Request - Invalid input |

| 401 | Unauthorized - Authentication required |

| 403 | Forbidden - Insufficient permissions |

| 404 | Not Found - Resource not found |

| 429 | Too Many Requests - Rate limit exceeded |

| 500 | Internal Server Error - Server error |

Portfolio API

Get current portfolio with live prices

Source: backend/app/api/portfolio.py:45-78

Add or update position

Source: backend/app/api/portfolio.py:80-123

Delete a position

Source: backend/app/api/portfolio.py:191-212

Run portfolio optimization

Source: backend/app/api/portfolio.py:125-189

Get portfolio performance metrics

Source: backend/app/api/portfolio.py:214-267

Get historical portfolio snapshots

Source: backend/app/api/portfolio.py:269-312

AI Analysis API

Run AI analysis

Source: backend/app/api/marketsense.py:34-112

Get historical analyses for a symbol

Source: backend/app/api/marketsense.py:114-156

WebSocket endpoint for agent console

Source: backend/app/api/websocket.py:23-67

RAG API

Query quant research library

Source: backend/app/api/rag.py:45-98

Query SEC filings

Source: backend/app/api/rag.py:100-156

List available research papers

Source: backend/app/api/rag.py:158-189

Index a new research paper

Source: backend/app/api/rag.py:191-234

Database API

Get fundamentals data

Source: backend/app/api/database.py:34-67

Update fundamentals (single or bulk)

Source: backend/app/api/database.py:69-115

Get price history

Source: backend/app/api/database.py:117-165

Update price history

Source: backend/app/api/database.py:207-256

Get news articles

Source: backend/app/api/database.py:167-205

Update news articles

Source: backend/app/api/database.py:258-301

EODHD API

All EODHD endpoints are wrapped under /api/eodhd/* with caching and rate limiting.

Market Data Endpoints

Real-time quote

Source: backend/app/api/eodhd.py:45-78

Historical end-of-day prices

Source: backend/app/api/eodhd.py:80-125

Intraday prices (1min/5min/1h intervals)

Source: backend/app/api/eodhd.py:127-178

Fundamentals Endpoints

Company fundamentals

Source: backend/app/api/eodhd.py:180-245

Financial statements

Source: backend/app/api/eodhd.py:247-298

Calendar Endpoints

Earnings calendar

Source: backend/app/api/eodhd.py:235-278

IPO calendar

Source: backend/app/api/eodhd.py:280-315

Stock splits calendar

Source: backend/app/api/eodhd.py:317-352

News Endpoints

News articles for symbol

Source: backend/app/api/eodhd.py:354-389

See full EODHD API documentation for all 50+ available endpoints.

CrewAI Agent Framework

Overview

Chat with Fundamentals uses CrewAI for multi-agent orchestration in the AI Analysis system. CrewAI provides role-based agent collaboration with task delegation and tool sharing.

Agent Configuration

Agent Structure

from crewai import Agent, Task, Crew

# Define agent

agent = Agent(

role="Fundamentals Analyst",

goal="Analyze company financial statements",

backstory="Expert financial analyst with 15 years experience...",

tools=[fundamentals_tool, financial_statements_tool],

llm=ChatOpenAI(model="gpt-4"),

verbose=True

)Task Definition

task = Task(

description="Analyze AAPL financial statements and rate 1-10",

agent=fundamentals_agent,

expected_output="Numerical score with brief reasoning"

)Crew Orchestration

crew = Crew(

agents=[fundamentals_agent, news_agent, price_agent, macro_agent],

tasks=[fund_task, news_task, price_task, macro_task],

process=Process.parallel # Run agents in parallel

)

result = crew.kickoff()Custom Tools

Agents have access to custom tools for data retrieval:

Fundamentals Tool

@tool("Get Fundamentals")

def get_fundamentals(symbol: str) -> dict:

"""Get company fundamentals from database"""

return fetch_fundamentals_from_db(symbol)News Tool

@tool("Get News")

def get_news(symbol: str, days: int = 30) -> list:

"""Get recent news articles for symbol"""

return fetch_news_from_db(symbol, days)Price Tool

@tool("Get Price History")

def get_price_history(symbol: str, days: int = 365) -> list:

"""Get historical price data"""

return fetch_prices_from_db(symbol, days)WebSocket Logging

All agent activities are logged via WebSocket for real-time monitoring:

class WebSocketLogger:

async def log_agent_status(self, agent_name, status, message):

await self.ws.send_json({

"event": "agent_status",

"agent": agent_name,

"status": status,

"message": message,

"timestamp": datetime.now().isoformat()

})

async def log_task_complete(self, agent_name, output):

await self.ws.send_json({

"event": "task_complete",

"agent": agent_name,

"output": output

})Database Schema

Entity Relationship Overview

The database schema is designed around five core entities: Users, Portfolios, Symbols, Fundamentals, and Prices.

Core Tables

Users

users (

id SERIAL PRIMARY KEY,

email VARCHAR(255) UNIQUE NOT NULL,

hashed_password VARCHAR(255) NOT NULL,

created_at TIMESTAMP DEFAULT NOW(),

last_login TIMESTAMP,

is_active BOOLEAN DEFAULT TRUE

)Portfolios

portfolios (

id SERIAL PRIMARY KEY,

user_id INTEGER REFERENCES users(id) ON DELETE CASCADE,

name VARCHAR(200) NOT NULL,

description TEXT,

created_at TIMESTAMP DEFAULT NOW(),

updated_at TIMESTAMP DEFAULT NOW(),

UNIQUE(user_id, name)

)Positions

positions (

id SERIAL PRIMARY KEY,

portfolio_id INTEGER REFERENCES portfolios(id) ON DELETE CASCADE,

symbol VARCHAR(20) NOT NULL,

shares FLOAT NOT NULL,

avg_cost FLOAT NOT NULL,

transaction_date DATE NOT NULL,

created_at TIMESTAMP DEFAULT NOW(),

updated_at TIMESTAMP DEFAULT NOW()

)Symbols

symbols (

symbol VARCHAR(20) PRIMARY KEY,

name VARCHAR(200),

exchange VARCHAR(50),

asset_type VARCHAR(50), -- stock | etf | forex | crypto

sector VARCHAR(100),

industry VARCHAR(100),

country VARCHAR(50),

currency VARCHAR(10),

is_active BOOLEAN DEFAULT TRUE,

created_at TIMESTAMP DEFAULT NOW()

)Fundamentals

fundamentals (

id SERIAL PRIMARY KEY,

symbol VARCHAR(20) REFERENCES symbols(symbol),

market_cap BIGINT,

pe_ratio FLOAT,

forward_pe FLOAT,

peg_ratio FLOAT,

price_to_book FLOAT,

price_to_sales FLOAT,

debt_to_equity FLOAT,

current_ratio FLOAT,

quick_ratio FLOAT,

roe FLOAT,

roa FLOAT,

profit_margin FLOAT,

operating_margin FLOAT,

dividend_yield FLOAT,

eps FLOAT,

revenue BIGINT,

net_income BIGINT,

ebitda BIGINT,

free_cash_flow BIGINT,

last_updated TIMESTAMP DEFAULT NOW(),

UNIQUE(symbol)

)Price History (TimescaleDB Hypertable)

price_history (

time TIMESTAMP NOT NULL,

symbol VARCHAR(20) NOT NULL,

open FLOAT,

high FLOAT,

low FLOAT,

close FLOAT,

volume BIGINT,

adjusted_close FLOAT,

PRIMARY KEY (time, symbol)

);

-- Convert to hypertable for time-series optimization

SELECT create_hypertable('price_history', 'time');News Articles

news_articles (

id SERIAL PRIMARY KEY,

symbol VARCHAR(20) REFERENCES symbols(symbol),

title TEXT NOT NULL,

content TEXT,

source VARCHAR(200),

author VARCHAR(200),

published_at TIMESTAMP NOT NULL,

sentiment FLOAT, -- -1.0 to 1.0

url TEXT,

created_at TIMESTAMP DEFAULT NOW(),

INDEX idx_news_symbol_date (symbol, published_at)

)AI Analyses

ai_analyses (

id SERIAL PRIMARY KEY,

symbol VARCHAR(20) NOT NULL,

analysis_type VARCHAR(50), -- stock | etf | forex | macro

signal VARCHAR(10), -- BUY | HOLD | SELL

conviction INTEGER, -- 1-10

fundamentals_score INTEGER,

news_score INTEGER,

price_score INTEGER,

macro_score INTEGER,

reasoning TEXT,

risk_factors TEXT[],

llm_provider VARCHAR(50),

execution_time_seconds FLOAT,

created_at TIMESTAMP DEFAULT NOW(),

INDEX idx_analyses_symbol_date (symbol, created_at)

)Indexes

Key indexes for performance optimization:

-- Symbol lookups

CREATE INDEX idx_symbols_asset_type ON symbols(asset_type);

CREATE INDEX idx_symbols_sector ON symbols(sector);

-- Price queries

CREATE INDEX idx_prices_symbol_time ON price_history(symbol, time DESC);

-- News queries

CREATE INDEX idx_news_symbol_date ON news_articles(symbol, published_at DESC);

CREATE INDEX idx_news_sentiment ON news_articles(sentiment) WHERE sentiment IS NOT NULL;

-- Portfolio queries

CREATE INDEX idx_positions_portfolio ON positions(portfolio_id);

CREATE INDEX idx_positions_symbol ON positions(symbol);TimescaleDB Continuous Aggregates

Pre-computed aggregates for common queries:

-- Daily OHLCV from intraday data

CREATE MATERIALIZED VIEW daily_prices

WITH (timescaledb.continuous) AS

SELECT

time_bucket('1 day', time) AS day,

symbol,

first(open, time) AS open,

max(high) AS high,

min(low) AS low,

last(close, time) AS close,

sum(volume) AS volume

FROM price_history

GROUP BY day, symbol;

Portfolio Optimization Strategies

Implementation Details

1. Mean-Variance Optimization (Markowitz)

Implementation using PyPortfolioOpt:

from pypfopt import EfficientFrontier, risk_models, expected_returns

# Calculate expected returns and covariance

mu = expected_returns.mean_historical_return(prices)

S = risk_models.sample_cov(prices)

# Optimize for maximum Sharpe ratio

ef = EfficientFrontier(mu, S)

weights = ef.max_sharpe(risk_free_rate=0.045)

cleaned_weights = ef.clean_weights()

# Get performance metrics

performance = ef.portfolio_performance(risk_free_rate=0.045)

# Returns: (expected_return, volatility, sharpe_ratio)2. Minimum Variance

ef = EfficientFrontier(mu, S)

weights = ef.min_volatility()

cleaned_weights = ef.clean_weights()

performance = ef.portfolio_performance(risk_free_rate=0.045)3. Black-Litterman

from pypfopt.black_litterman import BlackLittermanModel

# Market equilibrium

market_caps = get_market_caps(symbols)

market_prices = get_prices(symbols)

# Investor views (optional)

viewdict = {

"AAPL": 0.20, # Expect 20% return

"GOOGL": 0.15

}

# Black-Litterman model

bl = BlackLittermanModel(

S,

pi="market",

market_caps=market_caps,

risk_aversion=2.5,

absolute_views=viewdict

)

# Get posterior returns

bl_returns = bl.bl_returns()

# Optimize

ef = EfficientFrontier(bl_returns, S)

weights = ef.max_sharpe(risk_free_rate=0.045)Constraints

Common constraints applied to all optimizations:

# Weight bounds

ef.add_constraint(lambda w: w >= 0) # No shorting

ef.add_constraint(lambda w: w <= 0.30) # Max 30% per position

# Sector constraints

sector_mapper = get_sector_mapper(symbols)

sector_lower = {sector: 0.05 for sector in sectors}

sector_upper = {sector: 0.40 for sector in sectors}

ef.add_sector_constraints(sector_mapper, sector_lower, sector_upper)Performance Attribution

Analyze portfolio performance by position:

def calculate_attribution(portfolio_weights, returns, benchmark_returns):

"""Calculate performance attribution vs benchmark"""

# Active weights

active_weights = portfolio_weights - benchmark_weights

# Allocation effect

allocation = active_weights * (benchmark_sector_returns - benchmark_return)

# Selection effect

selection = benchmark_weights * (returns - benchmark_sector_returns)

# Interaction effect

interaction = active_weights * (returns - benchmark_sector_returns)

return {

'allocation': allocation.sum(),

'selection': selection.sum(),

'interaction': interaction.sum()

}

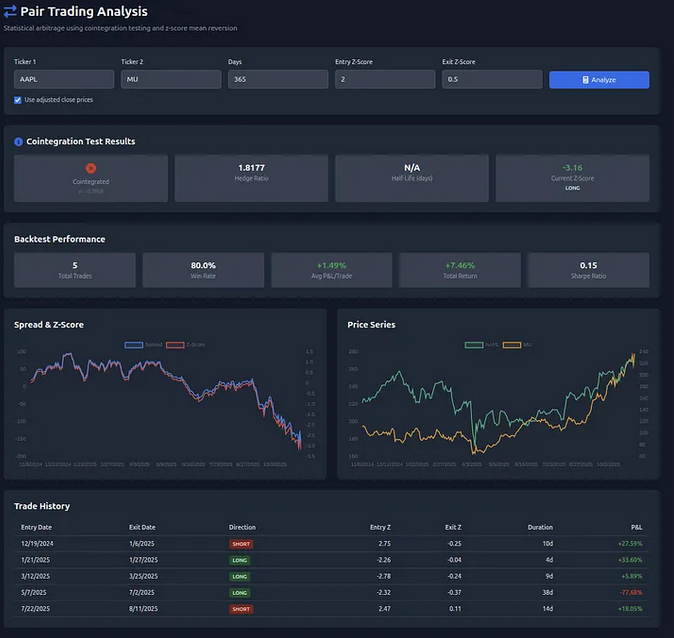

Risk Analytics

Value at Risk (VaR)

Calculate portfolio VaR using historical simulation:

def calculate_var(returns, confidence_level=0.95):

"""Calculate Value at Risk"""

return np.percentile(returns, (1 - confidence_level) * 100)Conditional Value at Risk (CVaR)

Expected loss beyond VaR threshold:

def calculate_cvar(returns, confidence_level=0.95):

"""Calculate Conditional Value at Risk"""

var = calculate_var(returns, confidence_level)

return returns[returns <= var].mean()Monte Carlo Simulation

Simulate future portfolio paths:

def monte_carlo_simulation(

current_value,

expected_return,

volatility,

years,

simulations=10000

):

"""Run Monte Carlo simulation of portfolio returns"""

days = years * 252

dt = 1/252

# Geometric Brownian Motion

results = np.zeros((simulations, days))

for i in range(simulations):

prices = [current_value]

for j in range(days):

drift = (expected_return - 0.5 * volatility**2) * dt

shock = volatility * np.random.normal() * np.sqrt(dt)

price = prices[-1] * np.exp(drift + shock)

prices.append(price)

results[i] = prices[1:]

return resultsRolling Sharpe Ratio

def calculate_rolling_sharpe(returns, window=252, risk_free_rate=0.045):

"""Calculate rolling Sharpe ratio"""

excess_returns = returns - risk_free_rate/252

rolling_mean = excess_returns.rolling(window).mean()

rolling_std = excess_returns.rolling(window).std()

return (rolling_mean / rolling_std) * np.sqrt(252)Correlation Analysis

def calculate_correlation_matrix(returns):

"""Calculate correlation matrix of returns"""

return returns.corr()

def find_diversification_opportunities(corr_matrix, threshold=0.3):

"""Find low-correlation pairs for diversification"""

pairs = []

for i in range(len(corr_matrix.columns)):

for j in range(i+1, len(corr_matrix.columns)):

corr = corr_matrix.iloc[i, j]

if abs(corr) < threshold:

pairs.append({

'asset1': corr_matrix.columns[i],

'asset2': corr_matrix.columns[j],

'correlation': corr

})

return sorted(pairs, key=lambda x: abs(x['correlation']))